The Growth of Japanese VC Investment into New Nordic Tech Start-ups Continues

Japan has been among the leading sources of foreign direct investment (FDI) outflows worldwide over the past decade. In 2019, outward FDI from Japan reached a record high of $80bn and comprised around 12% of the EU total in 2020.

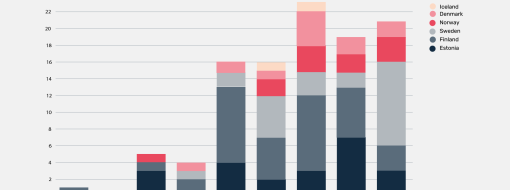

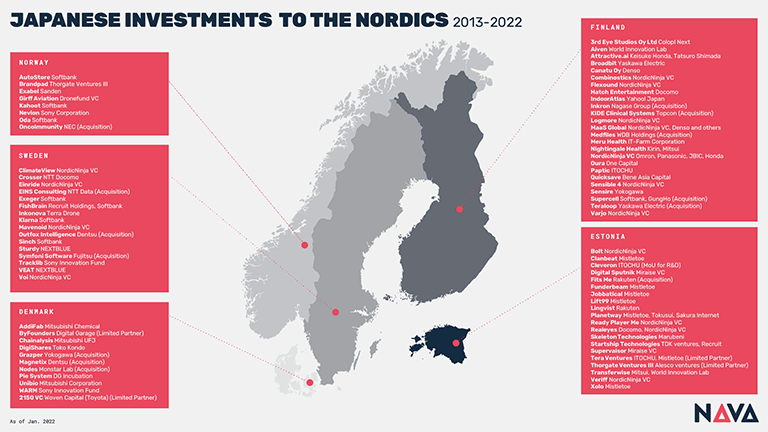

The COVID-19 pandemic saw a dramatic decline in outward FDI from Japan, but consequently saw a sustained surge of Japanese venture capital investment into the Nordic & Baltic region of Europe, the so-called “New Nordics”. This VC investment has been focused largely on tech start-ups and unearthing future unicorns, as well as scaling new solutions to both Japanese and global markets. Both 2020 and 2021 saw an average of 20 investments per year during the pandemic & resulting lockdowns. Particularly active players have included Softbank and Nordic Ninja VC - the biggest Japanese deeptech fund in Europe established only in 2019, and which has so far already made 17 New Nordic investments. Other large Japanese investors such as Mistletoe, Mitsubishi and Sony have also made significant investments. Aside from VC investment, a growing trend of Japanese investors becoming limited partners in New Nordic VC funds, such as Digital Garage, Toyota and Itochu has started.

But why the Nordics? Japan has a budding start-up ecosystem, yet not big enough to feed the market’s hunger for digital innovation. The New Nordics have always been at the forefront of digitalization, have a thriving start-up ecosystem, are a hotbed for international talent, and always dominate SDG rankings. Per capita, the New Nordics is the region that produces the most unicorns globally after Silicon Valley, has the highest start-up density and boasts the most cumulative investments.

For more information, the new Nordic Asian Venture Alliance is an open source, non-profit, pan-Nordic project that bridges the region with Japan. It launches in March, with the support of both investor & start-up ecosystems across the New Nordics & Japan.