Mergers & Acquisitions

— Latest update: May 2024 —

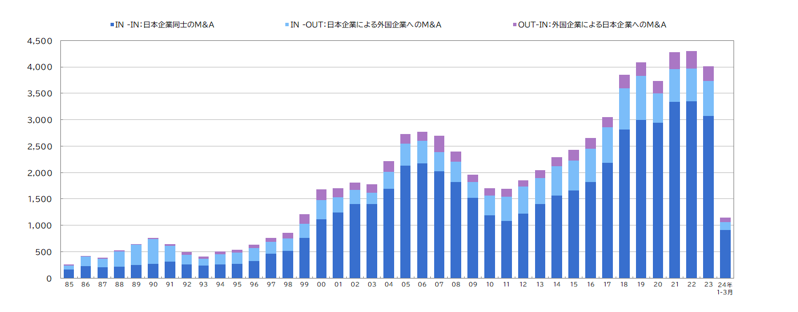

The Japanese M&A business represents a sector whose importance has been growing in the last few years. Before 2020, the number of Japanese M&A transactions and total transaction value was on a eight-year consecutive year-on-year increase streak.

In 2023, while the number of mergers and acquisitions (M&A) stood at 4,272, representing a decrease of 1.2% from 2022, the total transaction amount reached 28 trillion yen, reflecting a significant increase of 25% compared to the previous year. This disproportionate change, characterized by a stable number of M&A transactions and a notable surge in transaction amounts, is analysed as a recent trend marked by a rise in smaller-scale M&A activities among Small and Medium Enterprises (SMEs). Moreover, this trend is attributed to the limited number of successors within SMEs.

Considering that 99.7% of enterprises operating in Japan are categorized as SMEs and that M&A activities are increasingly prevalent among them, it is anticipated that the number of M&A transactions involving SMEs will continue to grow.

Figure 1 Change in the number of M&A, Source: M&A Capital Partners, 2023

M&A Capital Partners Co, 「M&Aの市場規模は?~2023年の実績から今後の動向を探る~」, 2023

Bloomberg, M&A市場拡大へ、海外企業による日本企業買収やMBO-投資銀幹部, 2024

Chamber and Partners, Corporate M&A , 2024

The Asahi Shimbun, Japan chalks up a record number of M&A deals in 2021, 2022

Bain & Company, Learning from Japan’s Disappointing M&A Boom, 2020

It is worth noting that in Japan, the Corporation Law defines the procedures for corporate mergers whilst the Japan Fair Trade Commission (JFTC) is responsible for mergers’ approval, while having to follow the Foreign Exchange and Foreign Trade Law (FEFTL).

Deloitte, International Tax and Business Guide, 2.5. Mergers and Acquisitions

IFLR, Japan: Less Regulation, 2008

Thomson Reuters Practical Law, Merger control in Japan: overview, 2021

Japan Fair Trade Commission, Enactment of the Act to Amend the Antimonopoly Act, 2019

Table of Contents

- Driving Forces Behind M&A in Japan

- Main Regulations Governing M&As

- Case Study: Japanese acquisitions of European Companies

- Particularities

- Business Culture and Corporate Governance in Japan; Keiretsu

- Challenges in Japan’s M&A Landscape

- Expert reports

- Annual Report

- Relevant organisations